Accounting straight line method calculator

Straight Line Depreciation Calculator. Use of the straight-line method is highly recommended since it is the easiest depreciation method to calculate and so results in few calculation errors.

Depreciation Formula Calculate Depreciation Expense

D j C-S nn dC-S n SLNC S n n In the straight-line method the depreciation.

. 40000 2000 5 7600 This means the depreciation expense for the first year of the asset is. The straight line method of depreciation is the simplest method of depreciation. Calculate the Straight Line Graph.

Calculate accounting ratios and equations. To calculate the depreciation rate divide the depreciation. Solve by elimination method calculator.

Depreciation expense 4500-1000 5 700. To calculate the straight line basis or straight line depreciation we use the following formula. Ad Get Complete Accounting Products From QuickBooks.

The straight line depreciation method is the most commonly used method for the calculation of depreciation expenses on income statements because its the simplest one. To calculate the straight-line depreciation rate for your asset simply subtract the salvage value from the asset cost to get total depreciation then divide that by useful life to get. Get Products For Your Accounting Software Needs.

The straight-line depreciation method is the easiest to use so it makes for simplified accounting calculations. The straight line depreciation method requires only that you determine the useful life of the asset estimate salvage value and calculate annual or even monthly depreciation. See below for a screenshot of the first months straight-line amortization schedule under ASC 840.

Straight Line Method Depreciation. A straight line basis is a method of computing depreciation and amortization by dividing the difference between an assets cost and its expected salvage value by the number. Ad Get Complete Accounting Products From QuickBooks.

Annual straight line depreciation of the asset will be calculated as follows. Straight Line Method. 2 Depreciation rate is always applied on original cost of asset.

The formula first subtracts the cost of the asset from its salvage value. The straight line depreciation method requires only that you determine the useful life of the asset estimate salvage value and calculate annual or even monthly depreciation. Straight Line Depreciation Calculator.

Using this method the cost of a tangible asset is expensed by equal amounts each period over. In year one you multiply the cost or beginning book value by 50. Straight Line Depreciation Calculator.

Depreciation is an accounting. 1 Depreciation rate and amount remain the same in each year of assets life. Accounting Course Accounting QA Accounting Terms.

When we enter those details into the formula for Straight Line Depreciation we get this. Here 700 is an annual depreciation expense. The straight-line depreciation method considers assets used and provides the benefit equally to an entity over its useful life so that the depreciation charge is equally.

- 85 OFFFinancial Accounting Accelerator httpbitlyfin-acct-reviewManagerial Accou. Straight Line Method SLM According to the Straight line method the cost of the asset is written off equally during its useful life. The straight-line method of depreciation posts the same rand amount of depreciation each year.

Therefore an equal amount of depreciation is charged every. Get Products For Your Accounting Software Needs.

Straight Line Depreciation Calculator Double Entry Bookkeeping

Macrs Depreciation Calculator With Formula Nerd Counter

Straight Line Depreciation Formula Guide To Calculate Depreciation

4 Steps To Calculate Depreciation Using The Straight Line Method Youtube

:max_bytes(150000):strip_icc()/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)

Depreciation Definition

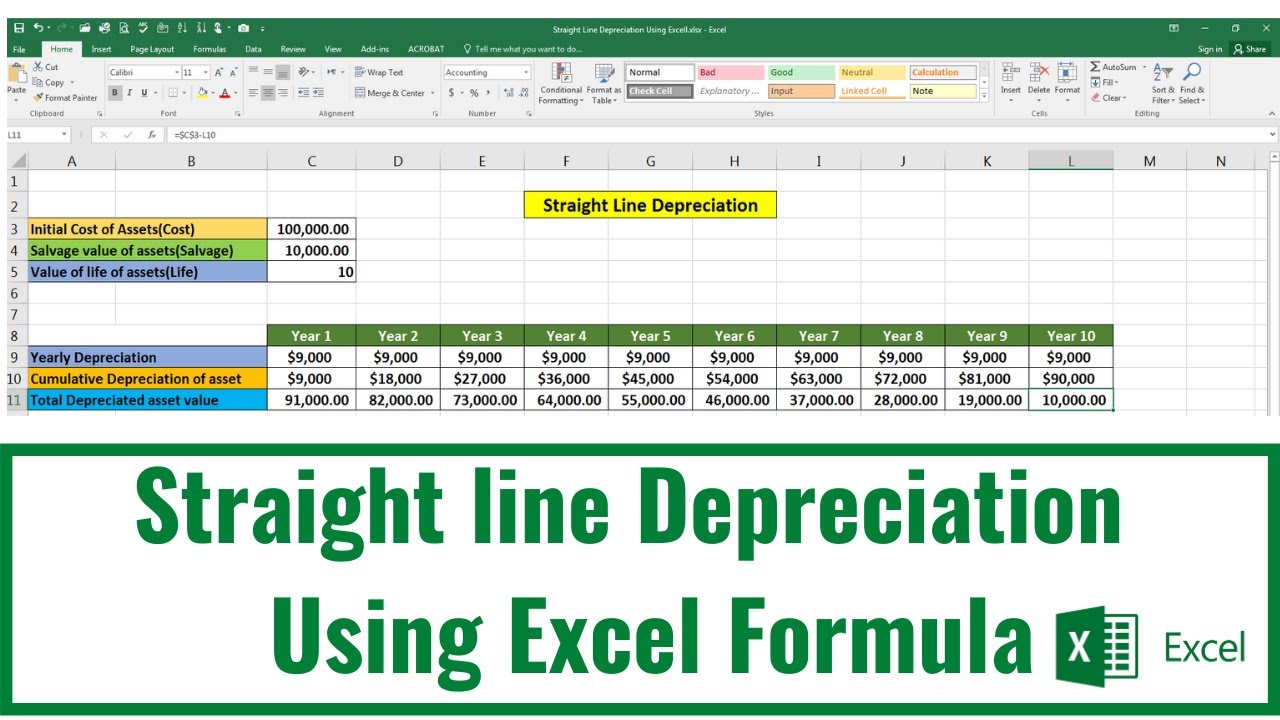

Practical Of Straight Line Depreciation In Excel 2020 Youtube

Straight Line Depreciation Formula And Calculation Excel Template

Depreciation Formula Examples With Excel Template

What Is The Straight Line Depreciation Formula How To Calculate Straight Line Depreciation Video Lesson Transcript Study Com

Straight Line Depreciation Tables Double Entry Bookkeeping

Straight Line Depreciation Schedule Calculator Double Entry Bookkeeping

Straight Line Depreciation Formula And Calculation Excel Template

Method To Get Straight Line Depreciation Formula Bench Accounting

Straight Line Bond Amortization Double Entry Bookkeeping

1 Free Straight Line Depreciation Calculator Embroker

Straight Line Depreciation Formula Guide To Calculate Depreciation

Straight Line Depreciation Double Entry Bookkeeping