Adp tax withholding calculator

Ad Reliably Fast And Accurate Payroll Tax Service By ADP. Our free paycheck calculator makes it easy for you to calculate pay and withholdings.

Pin On My Saves

Talk To ADP Sales About Payroll Tax HR More.

. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide. You can use the Tax Withholding Estimator to estimate your 2020 income tax. Talk To ADP Sales About Payroll Tax HR More.

A bonus paycheck tax calculator can help you find the right withholding amount for both. Ad Payroll So Easy You Can Set It Up Run It Yourself. To find the per payroll amount you would divide by the number of payroll periods as outlined in step 1.

For help with your withholding you may use the Tax Withholding Estimator. Use ADPs New York Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Ad Reliably Fast And Accurate Payroll Tax Service By ADP.

Want to change user ID or password. Important Note on Calculator. To calculate the hourly rate for a salaried employee divide the yearly salary by 52.

Important Note on Calculator. This amount is the annual tax amount for the employee. Important Note on Calculator.

Get Started Today with 2 Months Free. Talk With ADP Sales Today. Normal Net Tax 060 Supplemental Wage Bonus Rates Flat Rate Withholding Method Unchanged from 2021 22 Pay over 1 Million Unchanged from 2021 37 Health.

How do I calculate hourly rate. For example divide an annual salary of 37440 by 52 which equals a weekly pay amount of. Just enter the wages tax withholdings and other information required.

For instance a paycheck calculator can calculate your. Employees should fill out Form W-4 when they first begin. The IRS recommends that taxpayers access the online W-4 Calculator to check their payroll withholding and adjust withholding allowances if needed as early as possible.

The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and. First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52. Estimate your federal income tax withholding See how your refund take-home pay or tax due are affected by withholding amount Choose an estimated withholding amount that.

54000 87000. You can use the withholding charts in Publication 15 or payroll software to calculate income tax withholding. Next divide this number from the.

Find copies of current unemployment withholding IRS ADP and other forms using this extensive repository of tax and compliance-related forms and materials. Hourly Paycheck Calculator Loading calculator. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and.

Get Your Quote Today with SurePayroll. Our free salary paycheck calculator below can help you and your employees estimate their paycheck ahead of time. Youre almost done be sure to include federal filing details and extra tax.

All Services Backed by Tax Guarantee. ADP payroll is one of the most popular choices on the market for payroll software. Talk With ADP Sales Today.

The Fine Print Reading Your Pay Stub Statement Template Resume Template Free Words

Pay Stub Example Check More At Https Nationalgriefawarenessday Com 6742 Pay Stub Example Financial Information Letter Example Templates

2

2

10 Free Payroll Check Templates Ms Word Excel Pdf Samples Payroll Checks Payroll Template Payroll

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

2

Pay Stub Preview Payroll Template Money Template Good Essay

Hourly Paycheck Calculator Calculate Hourly Pay Adp

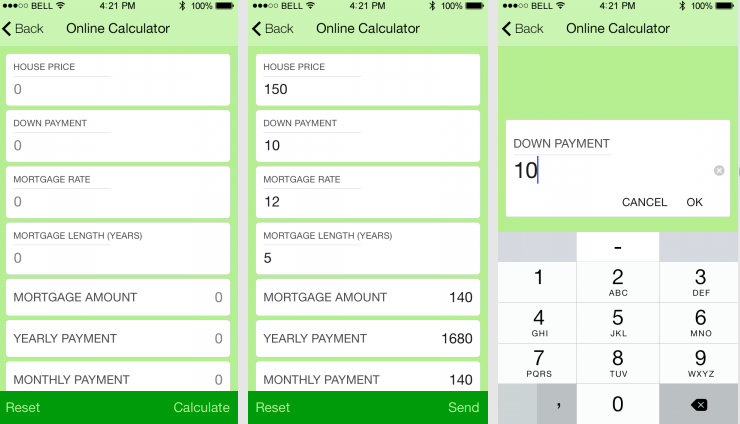

Create Your Own Adp Tax Payroll Hourly Paycheck Calculator App

2

Hourly Paycheck Calculator Calculate Hourly Pay Adp

29 Free Payroll Templates Payroll Template Payroll Checks Invoice Template

Check Stubs Paycheck Employee Handbook Employee Handbook Template

Pin On Analytics

How To Calculate Federal Income Tax

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto